Now is the time to turbocharge investment in homegrown energy, accelerate renewables and rewire Britain. The private and public sectors must run together and ramp-up investment and deliver the energy transition that will unlock Britain's potential.

Investing billions in energy infrastructure

We’re fully committed. That’s why we’re investing around £33bn to 2030 as part of our Transformation for Growth programme. We expect to allocate ~ 82% into networks, ~ 12% into renewables, and ~ 6% into other businesses, including gas and low-carbon flexible generation technologies.

And we’re just getting started. We’re ready to continue our investment plans well beyond 2030, because actions, not ambitions, will secure our energy future and help Britain become a clean energy superpower.

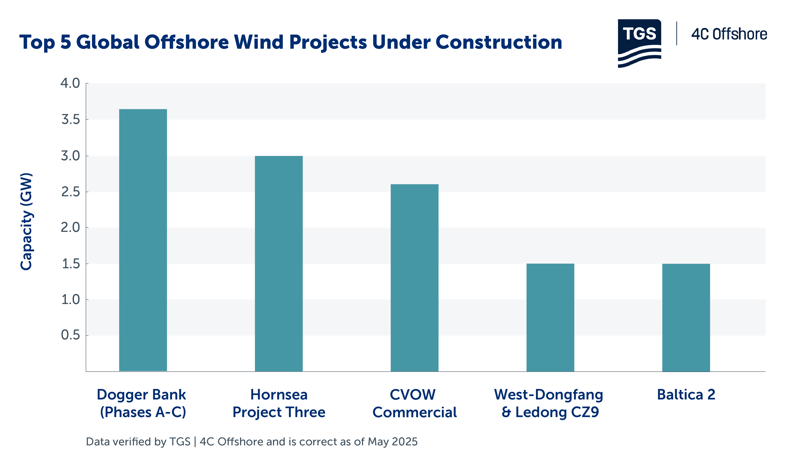

Dogger Bank – the world's largest offshore wind farm

Along with our joint venture partners, Equinor and Vårgrønn, we’re building the world’s largest offshore wind farm at Dogger Bank in the North Sea.

Dogger Bank will be delivered in 3 phases, each with an installed power generation capacity of 1.2GW. Once all phases are complete and operational, Dogger Bank will have an installed capacity capable of powering up to 6 million homes annually!*

In 2024-2025, our energy generation output was 43% renewables (including pumped storage, battery energy storage systems and biomass output and excludes constrained-off wind) and 57% non-renewable sources (Total excludes output from joint venture power stations where SSE does not have operational control and includes 100% of output from joint venture power stations where SSE has full operational control under Power Purchase Agreements). We are committed to being operationally net zero by 2050, measuring and reporting on our science-based targets for carbon reduction and aiming to cut our carbon intensity by 80% from a 2017/18 baseline.

Transforming the grid

Our networks businesses play a critical role in the transition to a low-carbon future, by developing, building, maintaining and operating an efficient energy network which supplies electricity to communities, homes and businesses across the country.

We distribute power directly to 3.9 million homes and businesses across central southern England and the north of Scotland, and we’re also responsible for the electricity transmission network in the north of Scotland, which consists of underground and subsea cables, overhead lines and electricity substations. We cover over a quarter of the UK’s land mass and cross some of the most challenging and extreme terrain.

Supporting thousands of jobs

As part of the transition from high-carbon activity, we expect to support thousands of new jobs every year directly and indirectly, ensuring the benefits of our work are shared by our colleagues and communities.

We employ c.14,000 talented and skilled people directly across the SSE Group, and support over 53,000 jobs across the UK through our supply chain. We were the first company in the world to publish a Just Transition Strategy in 2020, which included a framework of principles to guide our decision-making to support greater fairness for those impacted by the changes that the journey to net zero entails. The transition to a net zero world brings lots of new opportunities for both the existing workforce and new entrants.

Flexible back-up generation

While renewable energy generation will do the heavy lifting to decarbonise the UK’s power system and is at the core of our strategy, the UK continues to require flexible gas-fired power stations on the grid to provide reliable back-up power when the sun isn’t shining or the wind isn’t blowing.

We’re fully focused on providing flexible power in a way that is consistent with our science-based targets and delivering on our goals by reducing the carbon intensity of our operations. We’re exploring exciting opportunities in carbon capture and storage (CCS) and hydrogen technology, which we believe will allow flexible power stations to continue providing energy generation in a net zero world.